classic architecture details of a Bank building

Getty

One way to identify value stocks is to follow the basic criteria outlined by Benjamin Graham in his classic work on the subject The Intelligent Investor. Graham was Warren Buffett’s teacher at Columbia University and wrote extensively on valuation of equities.

Following that basic method, you might now come up with these 4 financial services stocks all of which trade everyday on the NASDAQ. Each one sells for less than its book value and each pays regular dividends.

These banks are not as widely followed as the money center institutions you’ve heard of that trade on the New York Stock Exchange, but they’re for real.

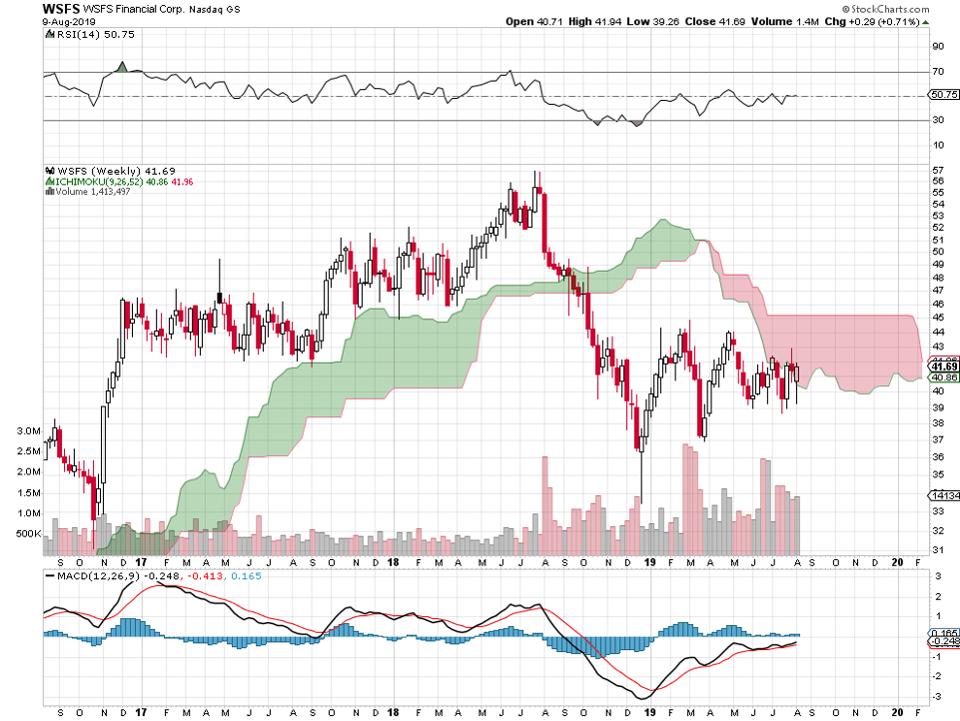

WSFS Financial is headquartered in Wilmington, Delaware where it was founded more than 180 years ago.

WSFS weekly price chart.

stockcharts.com

The stock trades at a 9% discount to book value with a price/earnings ratio of 13. Shareholder equity greatly exceeds long-term debt. Earnings were excellent last year and they’ve got a very good 5-year record.

WSFS is relatively lightly traded with an average daily volume of 283,000 shares. The company pays investors a 1.15% dividend.

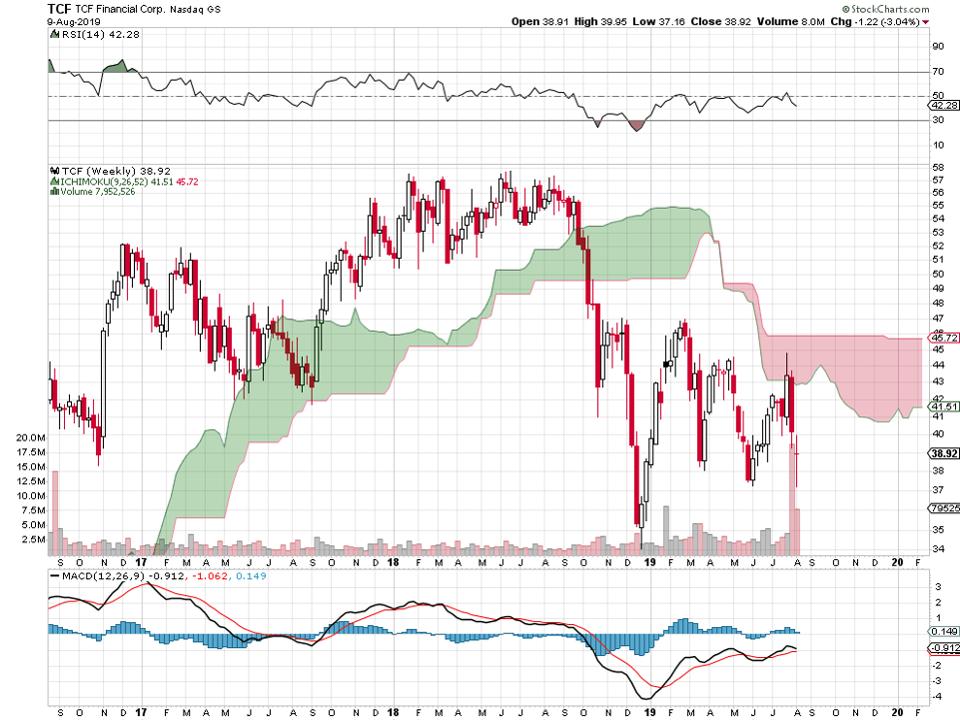

TCF Financial is based in Detroit, holds $47 billion dollars worth of assets and conducts business through 500 branch offices.

TCF Financial weekly price chart.

stockcharts.com

Earnings last year were very good and the same can be said for the past 5-year record. Analysts are concerned that next year’s results may be negative, so the stock has sold off recently.

Right now, TCF trades at a 6% discount to book value. The price/earnings ratio is 10. Investors receive a 1.54% dividend yield. The company has almost no long-term debt.

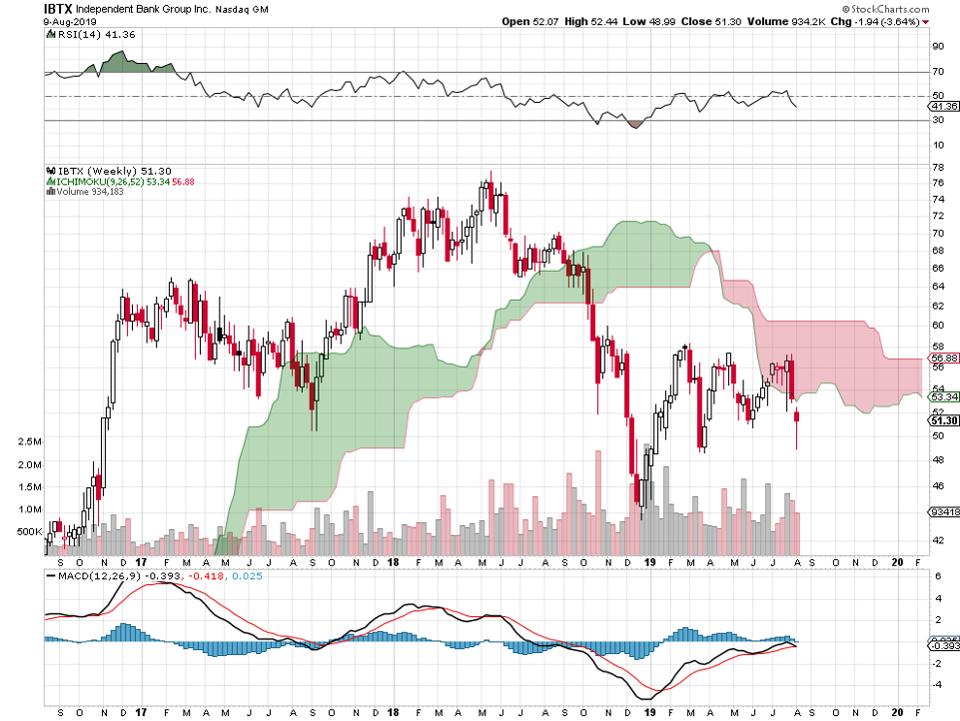

Independent Bank Group is based in Texas with operations that extend from that state to Colorado.

Independent Bank Group weekly price chart.

stockcharts.com

The stock can be purchased today at a discount of 2% from book value and the price/earnings ratio is relatively low at 10. The earnings record is quite good over the last 5-years and last year was good too.

Long-term debt is low and less than shareholder equity. Independent Bank Group pays a 1.95% dividend. Average daily trading volume is light at 208,000 shares.

IBERIABANK Corporation, founded in 1887, has headquarters in Louisiana and does business throughout the Southeastern United States.

IBERIABANK weekly price chart

stockcharts.com

Earnings this year are excellent and they’ve got a good 5-year record as well. IBERIABANK has little debt and now trades at a 3% discount to its book value. They’re paying a dividend yield of 2.5%.

The price/earnings ratio of 10 is well below that of the S&P 500 right now. The stock is lightly traded with an average daily volume of 315,000 shares.

These are all regional bank stocks and can be greatly affected by whatever is going on locally — a bit different than some of the huge NYSE-listed financial institutions that may be more generally influenced by global conditions.

Stats courtesy of FinViz.com.

I do not hold positions in these investments. No recommendations are made one way or the other. If you’re an investor, you’d want to look much deeper into each of these situations. You can lose money trading or investing in stocks and other instruments. Always do your own independent research, due diligence and seek professional advice from a licensed investment advisor.