Pound Sterling mounted a considerable recovery over recent weeks with GBP to EUR and USD exchange rates trading at or close to fresh highs as fears of no-deal Brexit recede.

Nevertheless, the GBP remains thoroughly depressed relative to a basket of major and minor currencies in 2019 overall, which for those travelling abroad means a more expensive trip.

For would-be holidaymakers, a weaker Pound unfortunately means less spending money when abroad. However, we’ve put together a list of top holiday destinations and the best travel money deals for September 2019 to help travellers maximise their purchasing power abroad.

As ever, we’ve also included a list of top tips top avoid falling into common pitfalls when exchanging currency and maximise your money when converting to a foreign currency.

Indian Rupee Becomes Worst Performing Asian Currency

While it might not be a consideration for many when picking a holiday destination, fluctuations in currency exchange rates can have a considerable bearing on how much spending capacity you’ll have when you travel abroad. A decline in the Indian Rupee offers just such an opportunity with the INR hemorrhaging value over August and into September, relinquishing the title of top performing Asian currency earlier in the year to now sit firmly at the bottom of the Asian FX space.

Initially, given such a massive domestic market, India’s economy was relatively well insulated from the US-China trade war. However, recent weeks have seen massive capital outflows from domestic assets and the INR becoming increasingly entangled with the Chinese Yuan, spurring a sharp fall over August as US-Sino friction picked up.

Its hard to sum up just how much India has to offer the prospective tourist. “From the snow-dusted peaks of the Himalaya to the sun-splashed beaches of the tropical south, the country has a bounty of outdoor attractions,” wrote lonelyplanet.com’s travel gurus, adding “The array of sacred sites and rituals pay testament to the country’s long and colourful religious history. And then there are its festivals! India has an abundance of devotional celebrations – from formidable city parades heralding auspicious religious events, to simple village harvest fairs that pay homage to a locally worshipped deity.”

Above: Taj Mahal India

At the time of writing, BestForeignExchange were offering the most competitive tourist rate on the Pound Sterling to Indian Rupee with 1 GBP = 84.8000 INR meaning a £500 spend equates to INR 42400 (collection only).

Including delivery, Asda were offering the currency conversion rate on the day with 1 GBP = 84.4682 INR (£500 = INR 42234.1) with free delivery on orders of £700 or more or £6 below.

Georgia – Southeast Asian Prices On the Edge of Europe

If you’re looking for Southeast Asian prices without the air fare, Georgia could be just the ticket. At the intersection of Europe and Asia, is a former Soviet republic that’s home to Caucasus Mountain villages and Black Sea beaches. There’s also the Vardzia, a sprawling cave monastery dating to the 12th century, and the ancient wine-growing region Kakheti.

Georgia ranked first in indietraveller.co’s top cheap places to travel for 2019 given you can get by on a backpackers budget of around $20 a day and even a mid-range budget is around $40 a day.

“It all starts in the eccentric capital of Tbilisi, where crumbling façades of traditional wooden Georgian houses stand next to Soviet-era architecture and daring contemporary designs. It’s a bit of a crazy architectural jumble, yet it has a gentle energy that will surely make you want to stay longer,” wrote indietraveller writer Marek, adding “From Tbilisi, you can explore the stunning Caucasian Mountain range, get your feet wet in the Black Sea, and visit ancient hilltop monasteries (and a few of them inside caves) all over the country. Oh yeah, Georgia is super cheap. In parts, it’s even cheaper than Southeast Asia. Don’t be surprised to find $5 dorms or $15 a night budget rooms.”

Above: Georgia Caucasus

While fantastically cheap, would-be travellers to Georgia might struggle to find the Georgian Lari in local exchanges. According to the Independent’s travel expert Simon Calder “American dollars have the edge. They are recognised everywhere and every adult Georgian knows the value of their currency in dollars.”

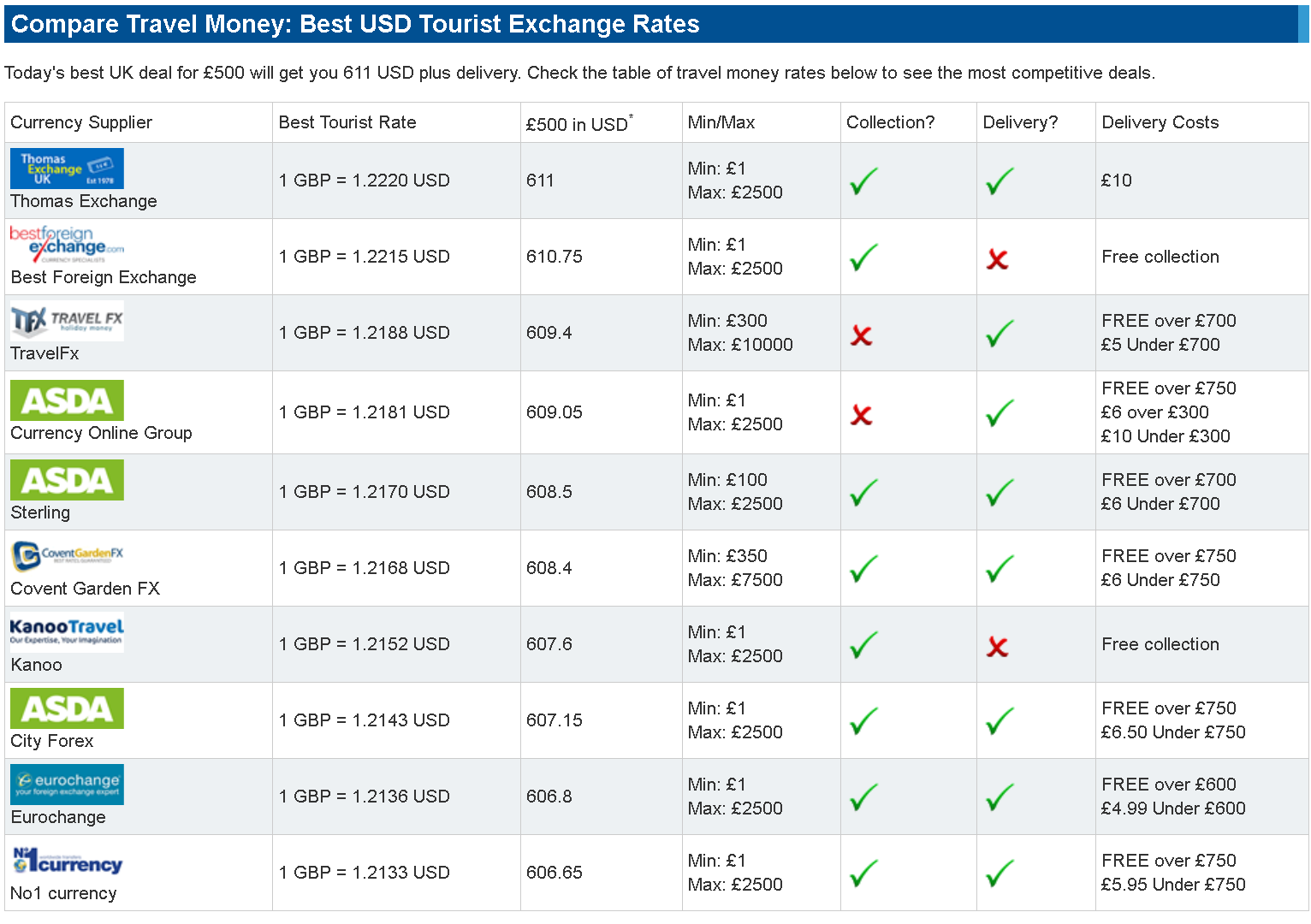

On the day, the best Pound to US Dollar exchange rate was being offered by Thomas Exchange UK with a tourist rate of 1 GBP = 1.2220 USD, meaning a £500 purchase would get you $611 with a £10 delivery charge.

With delivery, TravelFX were offering a very competitive conversion rate of 1 GBP = 1.2188 USD with free delivery on all orders over £700.

Above: Best Travel Money Deals for GBP/USD Exchange Rate

Nicaragua – Untouched Beaches and Rock Bottom Prices

With the recent rally in the Pound, the Sterling to Nicaraguan Cordoba exchange rate has now clawed its way out of the red and into the black, registering a gain in 2019 overall.

The largest country in Central America, Nicaragua ranked first in Skyskanner’s ’10 cheap dream destinations’ for 2019.

Skyscanner’s Anna Bailey explains why: “Untouched beaches, wild Pacific waves, beautifully preserved towns, no fewer than 19 volcanoes, idyllic islands galore… Need more persuasion?… How about brilliant hotel bargains, such as Granada’s highly rated El Almirante from £31 a night? Much of the country’s 550 miles of coastline is delightfully tourist-free and, with the calm Caribbean to the east and the surf waves of the Pacific to the west, there’s something to suit every type of beach dweller.”

Above: Volcano – Nicaragua

On the day, TravelFX were offering the most competitive exchange rate on the Nicaraguan Cordoba (NIO) with 1 GBP = NIO 20537.9795 and free delivery on orders of £700 or over.

Laos – THE Southeast Asia Destination for Adventurers

Ranking second on both Indietraveller and Skyscanner guides for cheap travel destinations for 2019, Laos is an often overlooked backpackers paradise wedged between the ever-popular Thailand and Vietnam.

“Laos is sparsely populated, mountainous, and has nearly 70% forest coverage, and this makes it a paradise for outdoor activities like trekking, climbing, kayaking, zip-lining, and hot air ballooning — all at extreme budget prices,” wrote Indietraveller, adding “Thanks to improved infrastructure Laos has become more accessible, but not while losing its low-key rural vibe. If you want to escape the crowds and crave some authenticity, skip Thailand and go to Laos.”

Above: Laos Mountain Temple

While already cheap, the Lao Kip (LAK) has become even cheaper over recent weeks with the strength of the US Dollar and Thai Baht pressuring the LAK lower and even forcing the Lao central bank to step in to stabilise the currency. You might struggle to find Kip in your local exchange but you can exchange hard currency in Vientiane and Luang Prabang relatively easily.

US Dollars are widely accepted and some of the smaller vendors only accept USD so if you’re considering a trip to Laos, exchanging GBP for USD is likely your best route.

At the time of writing, Thomas Exchange UK were offering the most competitive rate of 1 GBP = 1.2220 USD, meaning a £500 purchase would get you $611 with a £10 delivery charge. With delivery options, TravelFX were offering a very competitive conversion rate of 1 GBP = 1.2188 USD with free delivery on all orders over £700.

Cambodia – 5 Star Digs for Less than a Travel Lodge

Cambodia’s been on the radar for some time as a backpackers haven but over recent years its also grown in popularity for the more serious holidaymakers looking for an ‘authentic’ Southeast Asian experience with the added bonus that five-star accommodation generally costs lest per night than a Travel Lodge back home.

Lonelyplanet.com travel gurus wrote “There’s a magic about this charming yet confounding kingdom that casts a spell on visitors. In Cambodia, ancient and modern worlds collide to create an authentic adventure,” with Cambodia clinching the Lonelyplanet award for best in Asia Pacific 2019.

Above: Cambodian Buddhist Temple Illuminated

As with Laos and Nicaragua, you might struggle to find the Cambodian Riel in domestic exchanges. According to Gov.uk guidance “The US dollar is the main currency used in Cambodia. Prices in hotels, shops and restaurants are quoted in US dollars. Cambodian Riels (HKR) are used only as small change at a rate of around 4000 Riels/US$1.”

While you might want to wait until arriving in Cambodia to change your GBP for USD, its advisable to purchase your Dollars before hand given “There have been recent reports of counterfeit dollar notes being given as change in shops and clubs.”

General Tips for Cutting Costs When Exchanging Currency

While picking a destination where the domestic currency is relatively weak relative your currency of embarkation is a good first step in maximising your spending power abroad, there are a number of key steps we can take to avoid common pitfalls when purchasing travel money to ensure we get the absolutely best deal available.

First off, compare! There are literally hundreds of travel money operators vying for your business so don’t settle on the first quote you receive. There are dozens of reputable travel money comparison websites on the go allowing you to easily check the best rate on the day across hundreds of exchanges.

Exchange before you get. What could be worse than jetting half way round the world, purchasing your holiday money and finding out its fake? Counter-fitting has always been a problem but its particularly rife in holiday money markets wherein a visitor might be less able to distinguish between genuine and counterfeit bills. Save yourself the worry and whenever possible, exchange money before travelling abroad. Moreover, economies of scale come into play and larger UK travel money operators are likely to be much more competitive than small exchanges at your destination.

Avoid travel terminal exchanges. Whether its a railway stations, ferry terminal or airport, travel money vendors operating in these types of places offer some of the worst possible currency conversion rates. Given a captive audience its not surprising but with many travel money operators offering next-day delivery, even last minute purchases don’t have to come at exorbitant costs.

Opt for credit cards over debit. If you’re abroad and happen to run out of cash you might be faced with a choice between using a debit or credit card to settle a bill. In this case, the general rule of thumb is to opt for credit. Credit providers tend to offer more favourable rates than your bank but you’ll have to keep in mind any charges due as these could offset savings.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016, 2017 and 2018. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone. Find out more .

Advertisement