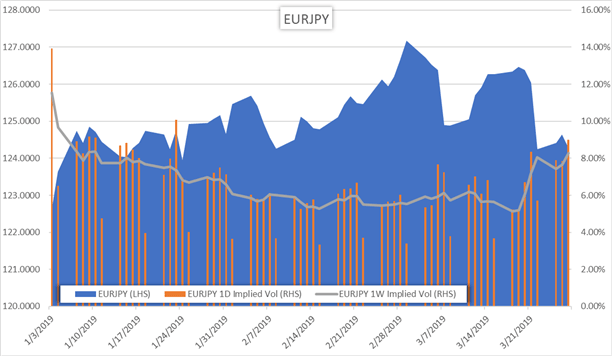

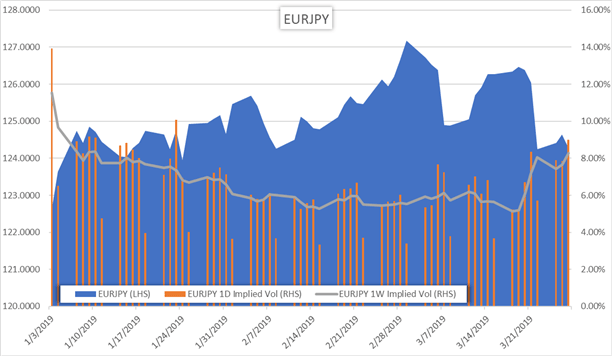

EURJPY IMPLIED VOLATILITY – TALKING POINTS

- EURJPY Implied volatility has crept up recently with the measure now sitting at its highest level since January

- Key events to watch for are the latest Consumer Price Index reading from Germany in addition to employment, industrial production and retail numbers out of Japan

- Check out the DailyFX Education Center for free Trading Guides and Forecasts

The Euro-Yen could see heightened price action in Thursday’s session judging by implied volatility on EURJPY overnight options contracts. In fact, EURJPY overnight implied volatility rose to 9.01 percent which is its highest level since January 23.

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Key events to watch for are the latest Consumer Price Index reading from Germany in addition to employment, industrial production and retail numbers out of Japan. Germany is expected to report a 1.5 percent year-over-year increase in its CPI – a print higher than consensus could put upward pressure on the Euro since higher inflation has potential to erode the ECB’s recent dovish position. Similarly, the Yen could take a dive If Japanese data disappoints and comes in below estimates.

FOREX ECONOMIC CALENDAR – EURJPY

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

EURJPY CURRENCY PRICE CHART: 4-HOUR TIME FRAME (FEBRUARY 28, 2019 TO MARCH 27, 2019)

EURJPY currency traders might expect the forex pair to trade between a range of 123.704 and 124.876 which creates a band 1 standard deviation away from spot prices using overnight implied volatility. Recent Eurozone weakness and riskaversion has sent forex traders flocking into the Japanese Yen and has resulted in a short-term downtrend for the EURJPY cross and is worth keeping an eye on for signs of continuation or a potential reversal higher.

The uptrend line formed from the low on March 22 and today has pushed spot EURJPY into a tight coil, however, and leaves the recent consolidation looking prime for a breakout. Drawing a Fibonacci retracement from March’s high and low points puts the 23.6 percent and 0.0 percent Fibs as potential short-term targets.

EURJPY TRADER CLIENT SENTIMENT

Check out IG’s Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to EURJPY trader data from IG, 53.8 percent of traders hold net long positions with the ratio of traders long to short at 1.16 to 1. However, the number of traders net-long is 3.4 percent lower than yesterday but remains 51.7 percent higher from last week.

– Written by Rich Dvorak, Junior Analyst for DailyFX

– Follow on Twitter