The world economy is experiencing a sudden stop that is without precedent in peacetime. Investors have now accepted that as an unpleasant fact and started to ask how the next stage — the exit from this sudden stop — will unfold. That, though, depends entirely on how fast the coronavirus lockdowns can be reversed.

The major economies have entered lockdown at different times — first China, then Europe and last the US — but most forecasts suggest that the annualised rate of decline in global gross domestic product in the first quarter of 2020 could approach minus 20 per cent, triple that recorded in the worst quarter of the Great Recession in 2009.

Federal Reserve officials have accepted that the US economy is probably already in recession, with new weekly activity estimates by the New York Fed showing a drop in GDP that is as deep, and much more rapid, than in 2008/09.

The latest US forecasts from Goldman Sachs show the trough of recession being reached in the second quarter of 2020, with GDP likely to be 11-12 per cent below the pre-virus reading. This would involve a dramatic decline at an annualised rate of 34 per cent in that quarter.

GDP is then projected to rise very gradually, not reaching its pre-virus path before the end of 2021. This pattern, implying almost two “wasted” years in the US, has been common in recent economic forecasts. A similar picture is expected in the eurozone, which is experiencing a collapse in manufacturing output more precipitous than in the 2012 euro crisis.

There is some cause for optimism from the partial recovery recorded in China in March. The Fulcrum Chinese nowcast shows that the month-on-month annualised growth rate rebounded to 4.6 per cent in March, compared with minus 2.0 per cent in February.

But China’s exports orders are weakening as foreign markets decline sharply. Industrial output growth is still markedly negative from a year earlier, and the State Council has had to announce new measures to restore economic growth in the second quarter. Beijing has also reintroduced partial lockdowns in several major cities in the past week.

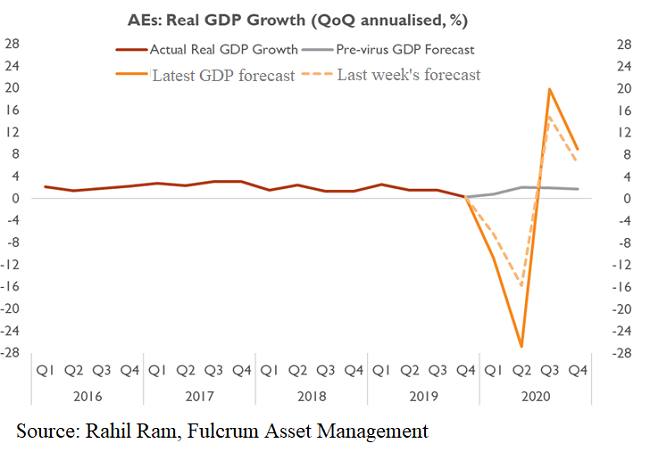

The central expectation of mainstream economic forecasters is of a strong global recovery in the third quarter (see graphs below). This would follow the pattern in mainland China and Hong Kong after the Sars crisis in 2003.

Since then, economists have generally viewed epidemics as inherently temporary events that need not cause long-term structural damage to productive capacity, provided widespread business failures and long-term unemployment are avoided. That is the basis for today’s consensus forecasts of recovery this year.

Coronavirus, however, is clearly having much more pervasive effects on worldwide economic activity than other epidemics, such as Mers, Ebola or swine flu. If there is a prolonged path to economic normalisation, lasting more than a few quarters, fiscal and monetary support for private corporate activity might encounter political resistance. Deep-seated recessionary forces could then take hold. The widespread weakness in equities last week suggested that markets think these risks are rising.

Is there any early escape route for the world economy?

An intelligent road map to reopening the economy, recently published by the American Enterprise Institute, suggests there is indeed a way of avoiding a very prolonged recession, based on virus and antibody testing with partial quarantining of affected citizens and localities. A localised, stop-start recovery is therefore about the best we can expect. But the institute has given no timetable for the stages of its plan, and it is hard to believe it could be completed before the end of this year.

Successfully managing the exit from lockdown will require skill and resolve across many areas of government policy. Unfortunately, the disorganised response to the virus so far in most of the major nations does not inspire much confidence about the likely speed of global economic recovery.

A new activity tracker released by the New York Fed shows US GDP growth slumping to -4.5 per cent, year-on-year, in the week of 21 March.

The latest “representative” forecasts by leading market economists, collected by Fulcrum, show the quarterly annualised growth rate in the advance economies bottoming in the second quarter of 2020, then rebounding strongly in the third quarter.