The stock market rally has come to a turning point. The major indexes and many leading stocks are pulling back in a manner that could foreshadow a bullish advance or bearish retreat. This will all take place amid stimulus talks, key coronavirus vaccine news and a presidential election. Oh, and earnings season kicks into higher gear, with the likes of Tesla (TSLA) and Netflix (NFLX) on tap.

X

Dow Jones futures will open Sunday evening, along with S&P 500 futures and Nasdaq futures. But here’s how how the stock market rally and leading stocks are shaping up.

The major indexes started last week with huge megacap tech gains, but then retreated. That’s allowed stocks such as Amazon.com (AMZN), Salesforce.com (CRM) and Shopify (SHOP) to carve handles on their new bases, creating lower buy points. Several other tech giants closing to doing so, including Apple (AAPL) and Microsoft (MSFT).

Tesla stock, Netflix and Lam Research (LRCX) are among the many notable earnings reports this coming weeks All three are near buy points.

Five Tech Giants Close To Finishing This Classic Bullish Base

If the the Nasdaq, Amazon, Shopify, etc. power higher toward record highs, that would be a positive signal. But falling back toward or below key support would raise serious concerns.

So, no pressure.

Tesla and Microsoft are on IBD Leaderboard. Apple, Amazon and Salesforce stock are on SwingTrader. Salesforce and Microsoft stock are on IBD Long-Term Leaders. Netflix, PayPal, Amazon, Lam Research and Microsoft are on the IBD 50.

Dow Jones Futures Today

Dow Jones futures won’t open until Sunday 6 p.m. ET, along with S&P 500 futures and Nasdaq 100 futures. Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze actionable stocks in the stock market rally on IBD Live.

Coronavirus News

Coronavirus cases worldwide reached 39.94 million. Covid-19 deaths topped 1.11 million.

Coronavirus cases in the U.S. have hit 8.34 million, with deaths above 224,000.

Stock Market Rally Last Week

The stock market rally jumped Monday, extending big recent gains. But then the major indexes pulled back,with the Nasdaq down for four straight sessions.

The Dow Jones Industrial Average edged up 0.1% in last week’s stock market trading. The S&P 500 index climbed 0.2%. The Nasdaq composite rose 0.8%.

Apple stock jumped 6.35% on Monday but closed the week up 1.75%. Microsoft settled for a 1.8% gain. Amazon dipped 0.4%.

While the megacaps faded after Monday, a number of leading stocks did very well last week. Zoom Video (ZM) broke out of a high tight flag pattern, continuing its massive 2020 run. Many new IPOs showed strength, even on Friday.

Still, growth stocks overall were just so-so. Among the best ETFs, the Innovator IBD 50 ETF (FFTY) ticked 0.2% higher. The iShares Expanded Tech-Software Sector ETF (IGV) popped 1.7%, helped by Microsoft stock but not Salesforce. The VanEck Vectors Semiconductor ETF (SMH) dipped 0.1%.

The IBD/TIPP 2020 Presidential Poll

Amazon, Shopify Stock Form Handles

While the likes of Apple and Microsoft still need a day or two to form proper handles, Amazon, Salesforce and Shopify all have handles thanks to their weekly losses.

Shopify stock just finished a handle on a cup base on both a daily and weekly chart, according to MarketSmith analysis. That offers a new buy point of 1130.10.

Amazon stock has a 3.496.34 handle on a weekly chart. It needs a couple days for a handle to appear on a daily chart.

Salesforce stock has 270.26 handle on a weekly chart. Like Amazon, a handle on a daily chart won’t be ready until after Tuesday.

Shopify and Amazon earnings are in less than two weeks.

Tesla, Netflix Near Buys With Earnings Due

Tesla, Netflix and Lam Research earnings are on tap this week. All three are close to buy points. But it’s highly risky to be buying just before earnings. All three of these stocks have a history of big earnings moves up and down.

Tesla earnings are due Wednesday night. Last Wednesday, Tesla stock moved past a 448.98 buy point. But it pulled back the next two days, undercutting that entry. It’s possible shares could have a handle as of Wednesday’s close, just in time for earnings.

Netflix earnings are due Tuesday night. Last Wednesday, Netflix stock surged past a 557.49 double-bottom buy point, but then reversed lower. Shares extended their retreat Friday. Arguably Netflix has a handle on a weekly chart, offering a 572.59 buy point. But investors may just want to use the left-hand side of the consolidation, giving a 575.47 entry.

Lam Research earnings are Wednesday night. Lam Research stock is close to a 387.79 cup base buy point. It’s possible a handle will develop over the next several days, but not before the quarterly results.

What’s Next For Market Rally?

The stock market rally started the week off strong, then pulled back, with the Nasdaq falling four straight days.

This could be a bullish pause before a new leg up for the major indexes and leading stocks. They seem to be forming handles, with some like Shopify and Salesforce already completed. But any time a stock is working on a handle, it’s a turning point. Can it break out, or is the “handle” really just the start of an extended pullback. When a stock breaks out, it’s no guarantee of success, but your odds are higher. That’s why you wait.

That’s especially true given this headline-driven market. Stimulus news could send stocks one way, then a few hours or days later coronavirus news could push it the other way. With earnings season kicking into full swing and Election Day looming, investors could face whipsaw action in the market and especially individual holdings.

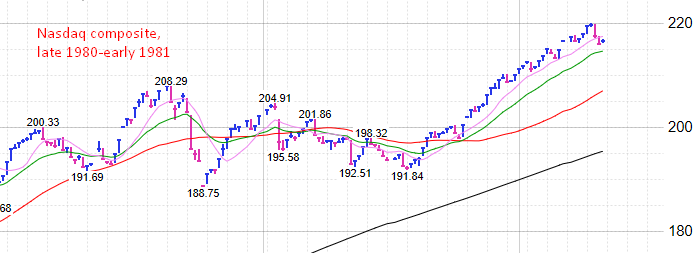

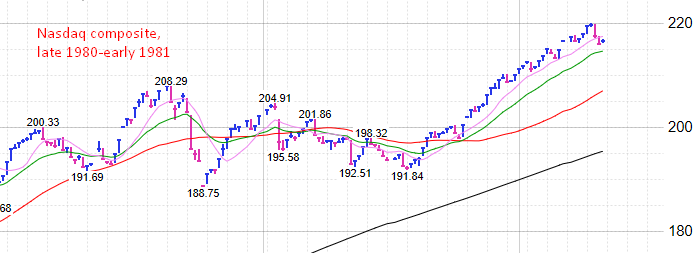

Echoes Of Nasdaq 1980-1981?

The current stock market rally does show similarities to the Nasdaq at the tail end of 1980. On Dec. 1, 1980, the Nasdaq hit a record 208.29, then pulled back nearly 10% to Dec. 11, tumbling through the 50-day line. The composite then rebounded over the next few weeks, moving toward all-time highs. But in early January, the Nasdaq sold off again and trended lower until late February. Only then did the Nasdaq rally and ultimately clear the Dec. 1 peak.

Of course, there are differences. The early December sell-off was not quite 10%, slightly smaller than the recent September correction. The Jan. 7, 1981 sell-off was fierce and pushed the Nasdaq below its 50-day line again.

Last week, the major indexes pulled back more gradually, and are well above their 50-day lines.

And even if the current stock market rally was a mirror image of the 1980-1981 Nasdaq, that wouldn’t the two would stay in sync going forward.

But, the bottom line is just because the Nasdaq and the megacap techs have quickly moved back toward record highs doesn’t mean that they will succeed in the near future.

What You Should Do Now

The next few weeks will require especially cool judgment. You don’t want to react to every intraday headfake, but you don’t want to ignore a change in the stock market trend.

As usual, you should continue to analyze your stocks and decide if any holdings should be pared. Refresh your watch lists. There are a lot of stocks shaping handles that could offer lower entries.

Active investors likely increased their exposure significantly during the past few weeks of the stock market rally, with many new positions already showing tidy gains. But right at this moment it’s probably a good idea to refrain from many new buys or increasing your net exposure until the stock market rally makes its next move.

If the stock market rally takes off, with the Nasdaq blasting above last week’s peak and making a final push toward all-time highs, your current portfolio should swell. Meanwhile, there were be a raft of new breakouts, offering chances to start or add to positions.

If the market falls back, you’ll be glad you didn’t step up your exposure. It’ll be easier to pare back your portfolio without panicking.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today