The pandemic has had a crushing blow on the world economy, with the threat of ‘long economic Covid’ looming in most parts of the world. With many businesses hurt, the second wave of the disease is expected to increase the financial fragility among rich as well emerging and developing economies.

Erik Fossing Nielsen

Erik Fossing Nielsen, group chief economist at Unicredit, shared an article by Martin Wolf who states that Covid-19 has not just crippled the healthcare system and people forever, but also the economy. Therefore, what started as a ‘long Covid’ threat will lead to a ‘long economic Covid’ threat, leading to years of debility. Policymakers are of the opinion that governments cannot retract from providing support in current times as they did after the 2008 financial crisis or they will have to bear the cost of inaction.

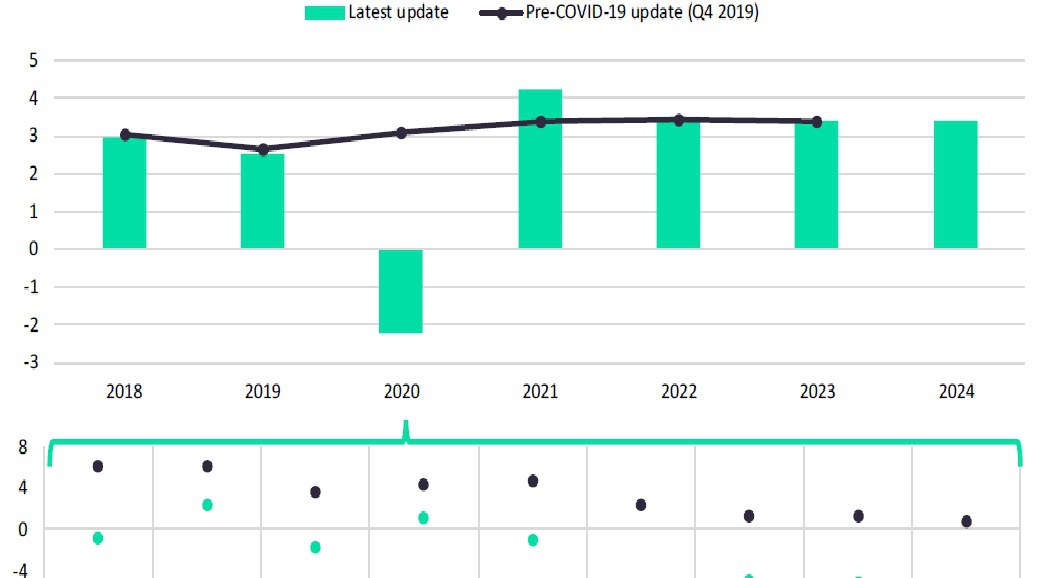

On the contrary, governments will have to fill in the gaps as the private sector pulls back. The International Monetary Fund (IMF) has already forecasted a dip in economic activity, which is most likely to keep private investments passive. The IMF also predicts slow growth of real gross domestic product (GDP) per head from 2019 to 2025, the article noted.

Brett House

Brett House, the vice-president and deputy chief economist at Scotiabank, re-tweeted on how governments’ response to the second wave of Covid-19 will determine how quickly world economies can spring back. Canada’s economy is witnessing a gradual recovery pattern and even outpacing that of its US counterparts, proof of effective measures in place to tackle the virus, added Jean-François Perrault, the senior vice-president and chief economist of Scotiabank. However, Quebec and Ontario are still reporting a record increase in cases, and therefore, this could be the resting point for Canada to recover from the health crisis.

Scotiabank predicts a global GDP dip of 4.1% in 2020, and rebound of 5.4% in 2021, as compared to an earlier forecast of 3.9% fall in 2020 and rebound of 5.6% in 2021. Although the unemployment levels remain above pre-Covid levels, governments’ fiscal support is keeping the global economies afloat. However, any untimely withdrawal of government support, like the one taking place in the US, can throw the economy into a sluggish pace next year, Scotiabank noted.

Stephen Tapp

Stephen Tapp, deputy chief economist and trade research director at Export Development Canada, shared insights from IMF’s fiscal monitor that reveals governments’ fiscal responses to the growing pandemic and their recovery plans. A staggering $12 trillion have been added globally to extend lifelines to households and firms, the publication highlighted. However, this and the global recession has contributed to a rise in global public debt. Experts believe that governments should providing fiscal support quickly, and help people get back their jobs as well as support struggling firms.

Policymakers are faced with urgent and painful trade-offs, with the health and education sectors having to the bear the brunt of the Covid-19 impact, the publication highlighted. Strained economies will need to focus on vulnerable sections and eliminate spending. The IMF has predicted falling standards of living in most parts of the world, with extreme poverty expected to reach 80 to 90 million.

Charlie Robertson

Charlie Robertson, global chief economist at Renaissance Capital, tweeted on an article shared by Justin Sandefur, a development economist on the conflicting perspectives of economists on how different policies were being adopted by different countries to curb the disease. Robertson agrees that countries such as the US should have had a focus on stringent lockdown measures and on the reduction in economic activity to help curb the spread of the Covid infection.

However, he also added that many countries such as Vietnam were not able to curb the infection even with lockdown restrictions. Instead, he tweets that the GDP lost from lockdowns could have been utilised to save lives and infused into the healthcare system.