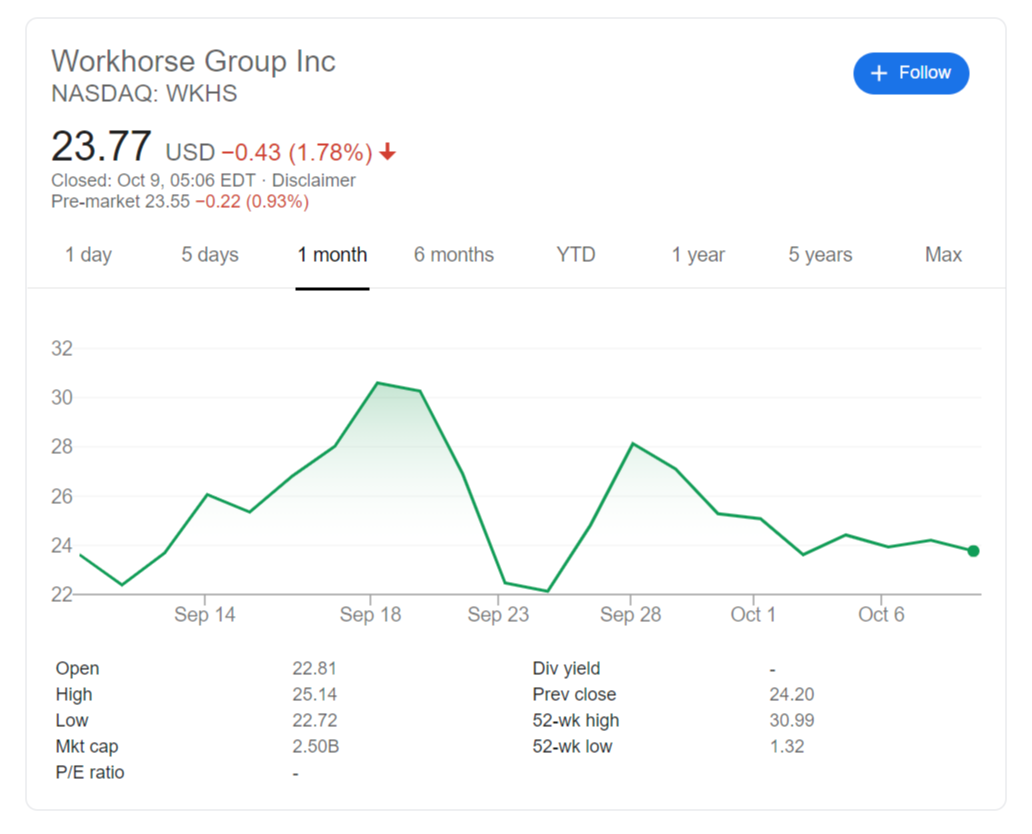

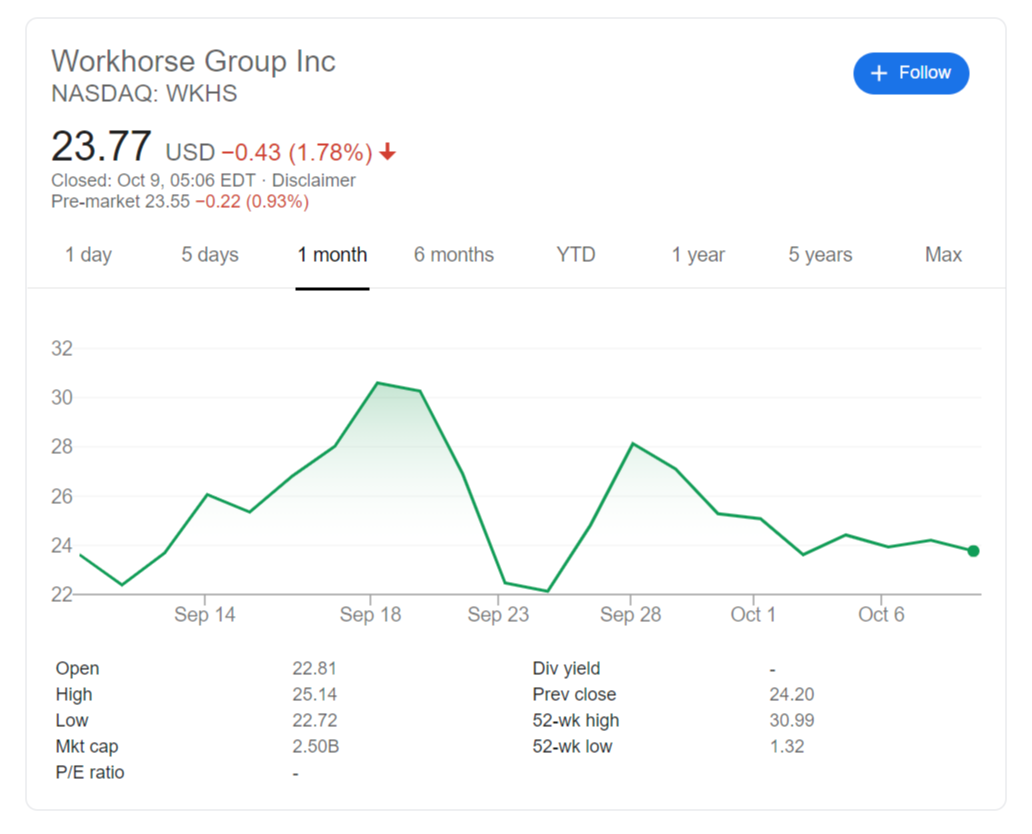

- NASDAQ: WKHS has room to edge lower ahead of a long weekend.

- Workhorse Group Inc is vulnerable to a broad market drop if fiscal stimulus is not enacted.

- The electric vehicle maker’s bullish outlook remains intact.

Christopher Colombus’s risky journey proved successful when he reached the western hemisphere on October 12, 1492. Nearing the same date some 528 years later, traders enjoy the long Colombus Day weekend – and may take some risks off the table, and that includes promising stocks like NASDAQ: WKHS.

Selling ahead of a long weekend is one reason to foresee some losses on stock markets. The other comes from a potential disappointment in fiscal stimulus talks. President Donald Trump made a U-turn and now wants a deal with Democrats – after sending shares lower by cutting off talks with Democrats earlier this week.

However, there reasons to believe a deal will not be struck, at least not now. First, the opposition party is in the lead in the polls and may be reluctant to give the president a win. Secondly, Senate Republicans are reluctant to spend more funds. They have rediscovered their concerns about the deficit and prefer to focus on the Supreme Court, especially as prospects for Trump look dire.

More WKHS Stock News: Workhorse Group Inc seems like a win-win on any election result

WorkHorse Group Inc has been trading in relatively moderate ranges lately – and sometimes in tandem with broader stock markets. If no company-specific news shows surprises investors, NASDAQ: WKHS could lean lower.

Nevertheless, that could provide a buying opportunity. The Ohio-based company is promising. The immediate financial attraction is Workhorse’s stake in Lordstown Motors, which makes electric trucks. The upcoming availability of Lordstown’s share on the stock market – potentially via a Special Purpose Acquisition Company (SPAC) would raise WKHS’ value.

Moreover, Workhorse’s own electric vehicles are on the US Postal Service’s shortlist for a lucrative contract. Merely passing from a group of 15 contenders to an exclusive one of only three already shows its strength and opens the door to additional deals.

NASDAQ: WKHS shares dropped by 1.78% to close at $23.77 on Thursday. The $22.13 trough recorded in late September is still far below, supporting the bullish case.

More WKHS Stock News: Workhorse Group Inc. set to extend gains, three bullish levels to watch